Table of Content

Let’s assume that you're leading a project that’s going well; deadlines are met, the team’s motivated, and everything seems on track. But suddenly, the budget spirals out of control. Doesn’t it sound familiar? That’s where Project Financial Management becomes your best ally. It helps you plan, track, and control every penny with confidence.

Project Financial Management acts as the backbone of successful delivery, ensuring your project doesn’t just look good on paper but performs well in real life, too. In this blog, we’ll explore what it involves, why it matters, and how you can master it.

Table of Contents

1) What is Project Financial Management?

2) Importance of Project Financial Management

3) Project Financial Management Challenges

4) Strategies to Effectively Manage Project Financials

5) Conclusion

What is Project Financial Management?

Project Financial Management focuses on planning, monitoring, and controlling financial resources within a project. It ensures that financial objectives are met while maintaining profitability. Proper management enhances efficiency and reduces financial risks.

This process includes budgeting, forecasting, cost control, financial reporting, and risk management. These elements help track expenses, anticipate financial challenges, and maintain discipline. Strong financial oversight prevents overspending and optimises resource allocation.

Effective Financial Management keeps a project within budget and aligned with strategic goals. It supports informed decision-making and ensures transparency in financial reporting. Ultimately, it helps deliver maximum value to stakeholders.

Importance of Project Financial Management

Effective Project Financial Management ensures that financial resources are allocated efficiently to meet project objectives. It helps maintain cost control, optimise resource utilisation, and enhance profitability. Proper financial oversight reduces risks and ensures financial stability throughout the project lifecycle.

Effective Project Financial Management offers several key benefits that contribute to the overall success and sustainability of a project, including:

a) Helps in accurate budgeting and cost estimation

b) Reduces financial risks and prevents cost overruns

c) Enhances financial transparency and accountability

d) Supports strategic decision-making and resource allocation

e) Ensures projects remain aligned with business goals

f) Maximises stakeholder value and overall project efficiency

Become a Certified Project Management Expert – Join PRINCE2® Foundation & Practitioner Course today!

Project Financial Management Challenges

Managing project finances effectively can be complex due to various uncertainties and constraints. Organisations must navigate financial risks, budgeting limitations, and cost fluctuations to ensure project success.

1) Budgeting Constraints

a) Limited financial resources can impact project scope and timelines

b) Unexpected costs may lead to budget overruns and financial strain

c) Inaccurate cost estimation can affect project feasibility and planning

d) Lack of contingency funds can disrupt project execution

2) Cost Overruns

a) Poor planning and estimation can lead to excessive spending

b) Scope creep increases project expenses beyond the initial budget

c) Delays and inefficiencies result in additional costs

d) Inadequate monitoring makes it difficult to track and control expenses

3) Financial Reporting and Compliance

a) Inconsistent reporting practices can lead to financial mismanagement

b) Lack of transparency affects stakeholder confidence and decision-making

c) Non-compliance with financial regulations can result in penalties

d) Poor documentation makes audits and financial assessments challenging

4) Resource Allocation Challenges

a) Inefficient distribution of financial resources can lead to wastage

b) Over/underutilisation of resources impacts project efficiency

c) Inaccurate forecasting affects hiring, procurement, and budgeting

d) Balancing financial needs across multiple projects can be difficult

5) Stakeholder Expectations and Alignment

Conflicting financial priorities can create challenges in decision-making

Unclear financial goals can lead to misaligned project objectives

Poor communication on financial matters reduces stakeholder confidence

Pressure to reduce costs can affect quality and project deliverables

6) Inadequate Financial Planning Tools

Lack of advanced Financial Management tools limits accurate forecasting

Reliance on outdated systems increases errors and inefficiencies

Poor integration between project management and financial software

Limited automation leads to time-consuming financial tracking

Advance your Project Management career – Join our PRINCE2® Practitioner Training Today!

Strategies to Effectively Manage Project Financials

Managing project financials requires a structured approach to budgeting, resource allocation, and financial forecasting. Organisations can minimise risks, control costs, and maximise project profitability by implementing strategic Financial Management practices. Here are key strategies to ensure financial success in project management.

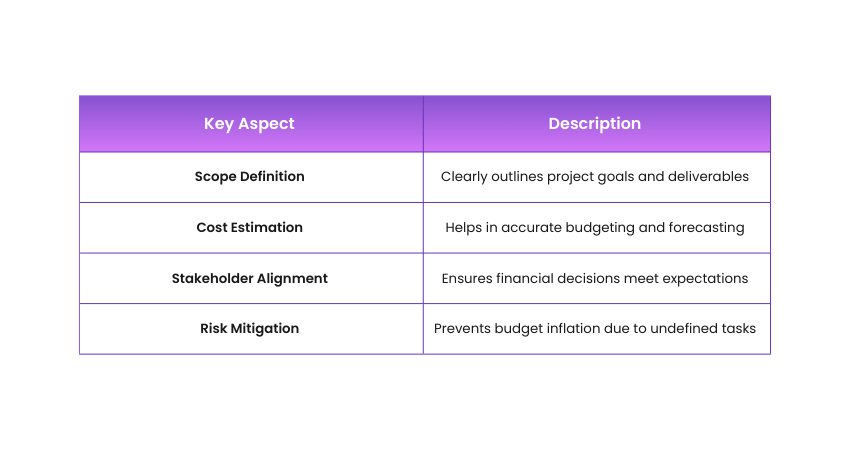

1) Clearly Define the Project Scope

Before estimating costs, establish a clear project scope, including goals, deliverables, tasks, and expected financial requirements. A well-defined scope statement aligns project activities with stakeholder expectations and prevents cost overruns due to scope creep. Key takeaways include:

a) Prevents scope creep and unexpected costs

b) Helps in resource planning and budget accuracy

c) Aligns financial planning with project objectives

d) Ensures transparency in financial decision-making

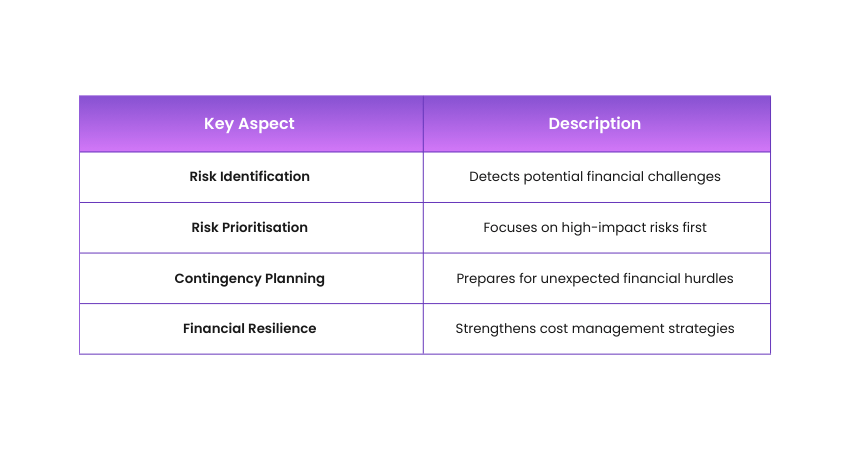

2) Identify and Mitigate Project Risks

Projects are inherently risky, and unforeseen events can impact financial performance. Conduct a thorough risk assessment, prioritise potential risks, and develop mitigation strategies to minimise financial disruptions. Maintaining a risk register helps track and manage risks effectively. Key takeaways include:

a) Enhances budget stability by anticipating risks

b) Reduces financial uncertainties and disruptions

c) Supports contingency planning and risk response

d) Improves financial resilience throughout the project

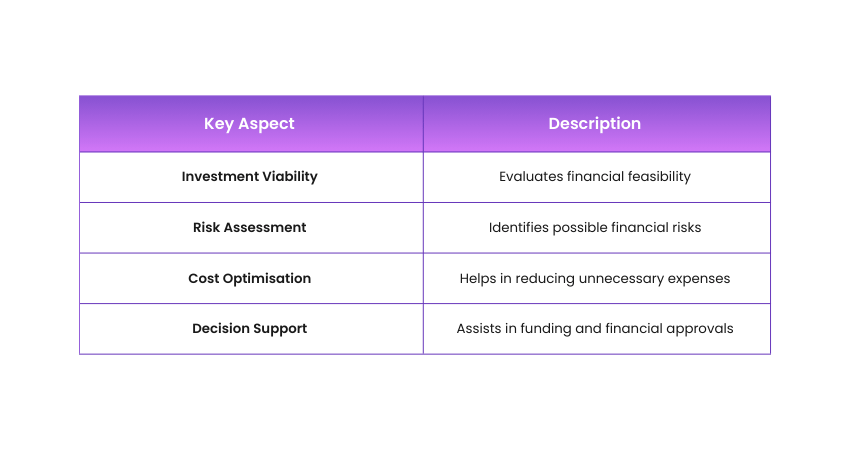

3) Conduct a Feasibility Study

Before investing in financial resources, assess whether the project is viable and worth the investment. A feasibility study identifies potential challenges, evaluates financial sustainability, and ensures the project aligns with business objectives. Key takeaways include:

a) Determines whether the project is worth the investment

b) Identifies cost-saving opportunities and risks

c) Supports informed decision-making before funding

d) Ensures project goals align with business strategy

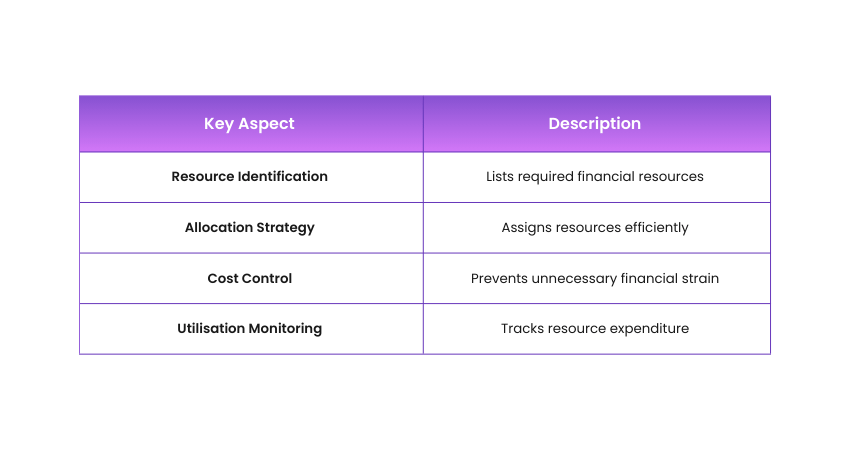

4) Develop a Comprehensive Resource Plan

Resources like including personnel, equipment, and materials; account for significant project costs. A resource plan outlines what is needed when it is required, and how resources will be allocated to optimise efficiency and control spending. Key takeaways include:

a) Ensures optimal resource utilisation and budgeting

b) Prevents financial inefficiencies and wastage

c) Aligns resources with project timelines and needs

d) Supports strategic resource allocation for cost control

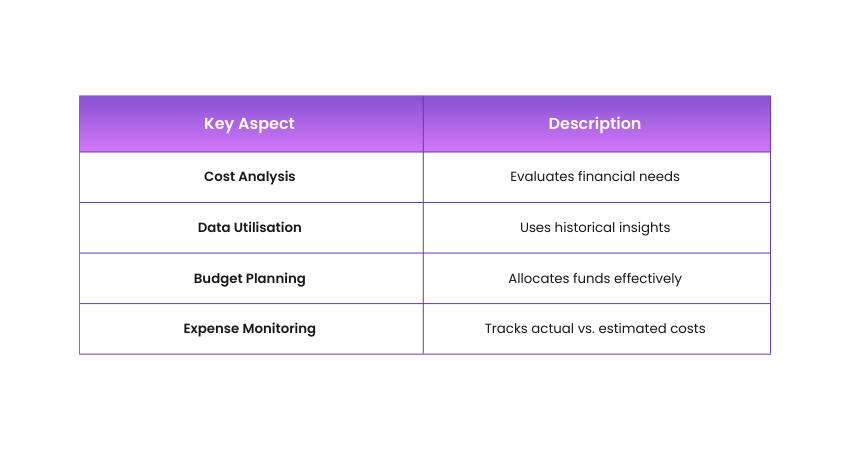

5) Estimate Project Costs Accurately

Cost estimation is critical for financial planning. Use historical data, industry benchmarks, and expert insights to estimate the cost of resources, labour, and other expenses. Accurate cost estimation prevents budget shortfalls and ensures proper financial allocation. Key takeaways include:

a) Prevents cost overruns and financial mismanagement

b) Enhances decision-making with data-backed estimates

c) Supports more efficient budget allocation

d) Reduces risks associated with unexpected expenses

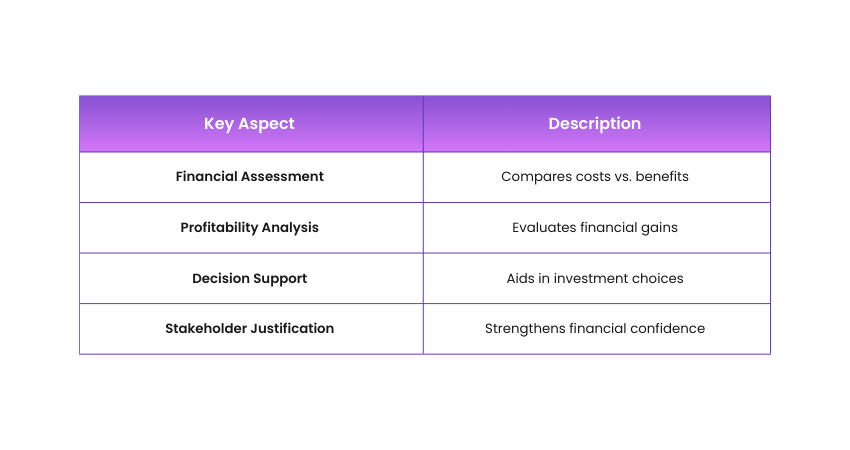

6) Perform a Cost-benefit Analysis

Evaluate project costs against expected benefits to determine financial feasibility. A cost-benefit analysis provides a data-driven assessment of whether the project will deliver sufficient value, helping stakeholders make informed investment decisions. Key takeaways include:

a) Helps in evaluating project profitability and sustainability

b) Supports strategic decision-making for financial investments

c) Enhances financial justification for stakeholders

d) Ensures resources are invested in high-value projects

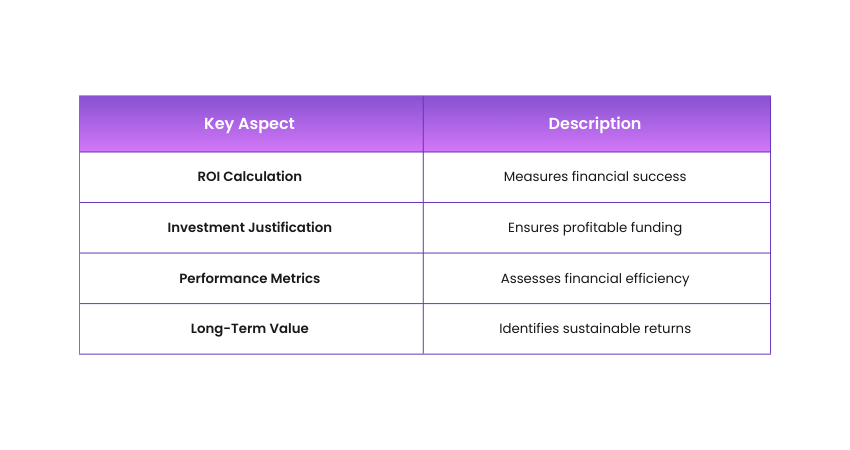

7) Calculate Return on Investment (ROI)

Measuring the project’s return on investment ensures financial viability. By assessing profitability and long-term financial gains, organisations can prioritise projects that yield the highest value and align with strategic goals. Key takeaways include:

a) Helps in financial prioritisation and investment decisions

b) Evaluates project profitability for long-term benefits

c) Assists in setting performance benchmarks

d) Enhances financial accountability in project execution

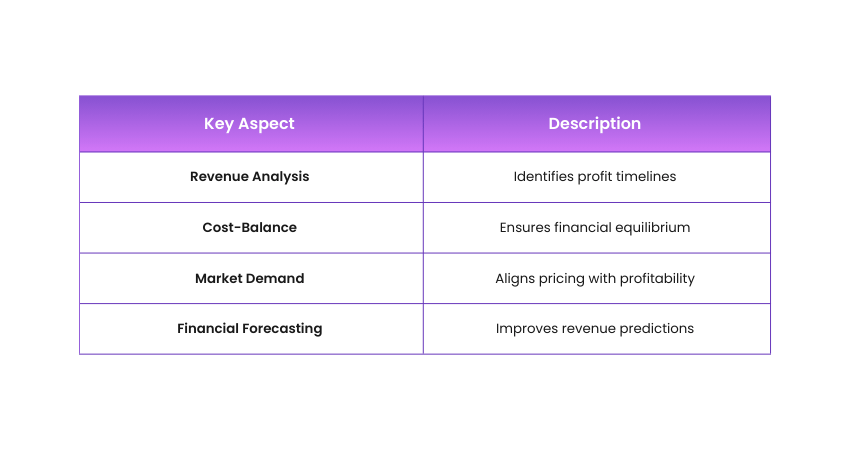

8) Determine the Project Break-even Point

Understanding the break-even point; when total costs equal total revenue, helps in financial decision-making. This is especially crucial for product launches, as it provides insight into the sales volume required to achieve profitability. Key takeaways include:

a) Identifies how long before a project becomes profitable

b) Helps in pricing strategies and cost recovery

c) Supports better financial planning and forecasting

d) Reduces uncertainty in revenue expectations

9) Develop a Detailed Project Budget

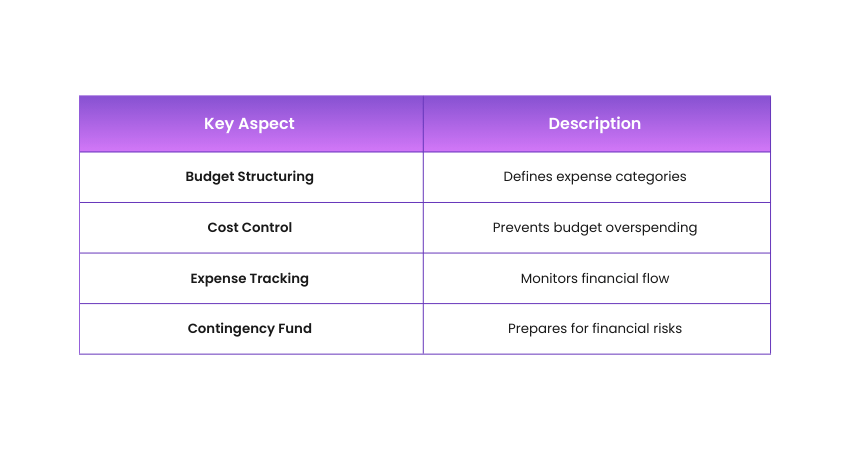

A well-structured budget is the foundation of Financial Management. Use a work breakdown structure to identify deliverables, estimate costs, allocate contingency funds for unexpected expenses, and establish a budget that supports project success. Key takeaways include:

a) Ensures financial discipline throughout the project

b) Helps in tracking and managing expenses effectively

c) Supports financial transparency with stakeholders

d) Reduces financial risks through proper forecasting

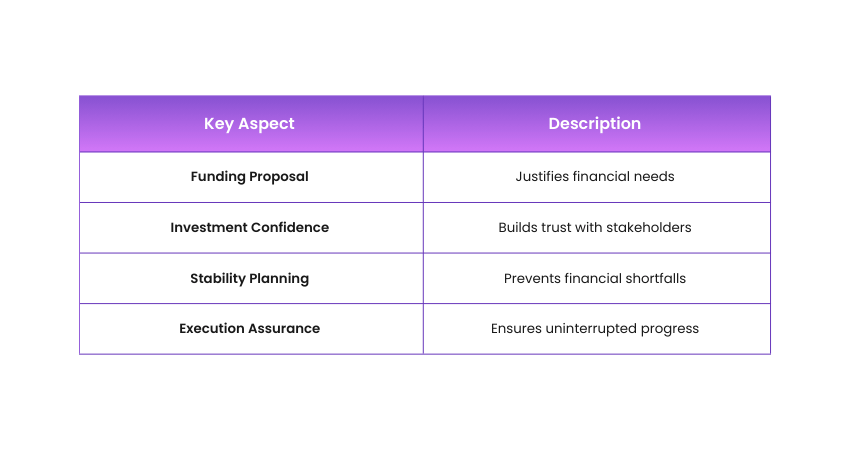

10) Secure Adequate Funding

Once the budget is finalised, present a compelling funding proposal highlighting project objectives, expected outcomes, and financial projections. Securing funding ensures sufficient financial resources to complete the project without disruptions. Key takeaways include:

a) Ensures availability of resources and financial stability

b) Strengthens stakeholder confidence and investment support

c) Prevents financial disruptions during execution

d) Enhances long-term financial planning and sustainability

Kickstart Your Project Management Journey – Join our PRINCE2® Foundation Training Today!

Conclusion

To wrap up, Project Financial Management is like the steering wheel of your project; without it, you are just guessing where you’ll end up. It turns plans into progress, budgets into breakthroughs, and surprises into strategy. Get it right, and your project doesn’t just cross the finish line, it leads the way.

Master Agile Project Management – Join our PRINCE2 Agile® Practitioner Course Today!

Frequently Asked Questions

What is the Role of a Financial Manager in a Project?

A Financial Manager oversees budgeting, cost control, financial reporting, and risk management to ensure financial stability, optimise resource allocation, and align project finances with business objectives.

How Do You Get Into Project Finance?

Gain a finance-related degree, develop analytical skills, and acquire certifications like CFA or PRINCE2®. Gain experience in financial planning, risk analysis, and investment management to enter project finance roles.

How do you Track Project Financials?

Use budgeting tools, financial reports, and KPIs to monitor expenses, cash flow, and forecasts. Regular audits, variance analysis, and automated financial systems help maintain transparency and control.

Contact@prince2training.co.uk

Contact@prince2training.co.uk 01344203999

01344203999

Back

Back

Continue Browsing

Continue Browsing